Creditors Voluntary Liquidation

It’s fair to say 2019 has presented more than a few challenges for small businesses. Legislative changes and increases in compliance requirements, all set against a backdrop of uncertain macro-economic times, combine to make difficult trading conditions.

If you are finding it difficult to meet your sales targets or worse still, your payment obligations to suppliers or indeed HMRC, then you will not be alone.

As a Director you have a legal requirement to address any liquidity concerns as soon as they arise. This would typically be to arrange an appointment with your Accountant to discuss options, failure to do this could result in certain corporate debts being transferred to you personally.

Having addressed the issue with your Accountant the prognosis is typically positive. UK insolvency law as it stands promotes and supports an enterprise culture, with the introduction of the Enterprise Act 2002, Crown preference in all insolvencies was abolished and an environment introduced where businesses in financial difficulty can be helped to recover or dissolved in an orderly way.

From April 2020 this may be about to change. The government will introduce legislation in the finance bill 2019-20 to amend the insolvency act, giving itself preferential status in insolvency cases, the Government has also stated it intends to introduce legislation to hold directors jointly and severally liable for losses resulting from abuse of the insolvency regime (phoenixism).

Given the imminence of these changes, if you are having issues with adverse trading and corporate debt, it may be wise to address these problems sooner, rather than later.

1000 ways to die

Its easy enough to create a Limited company, but the end of life can be far more complex, especially when the company has become insolvent. Administration, Compulsory Liquidation, Voluntary Arrangements, Administrative Receivership, these are but a few of the many different mechanisms available to manage the ‘winding up’ or recovery of a limited company in difficulty.

By far the most common route to winding up an insolvent limited company is a ‘Creditors Voluntary Liquidation’ or CVL. This is where the shareholders themselves pass a resolution that the company be wound up.

A CVL is a corporate insolvency procedure and not a personal insolvency.

You do the math

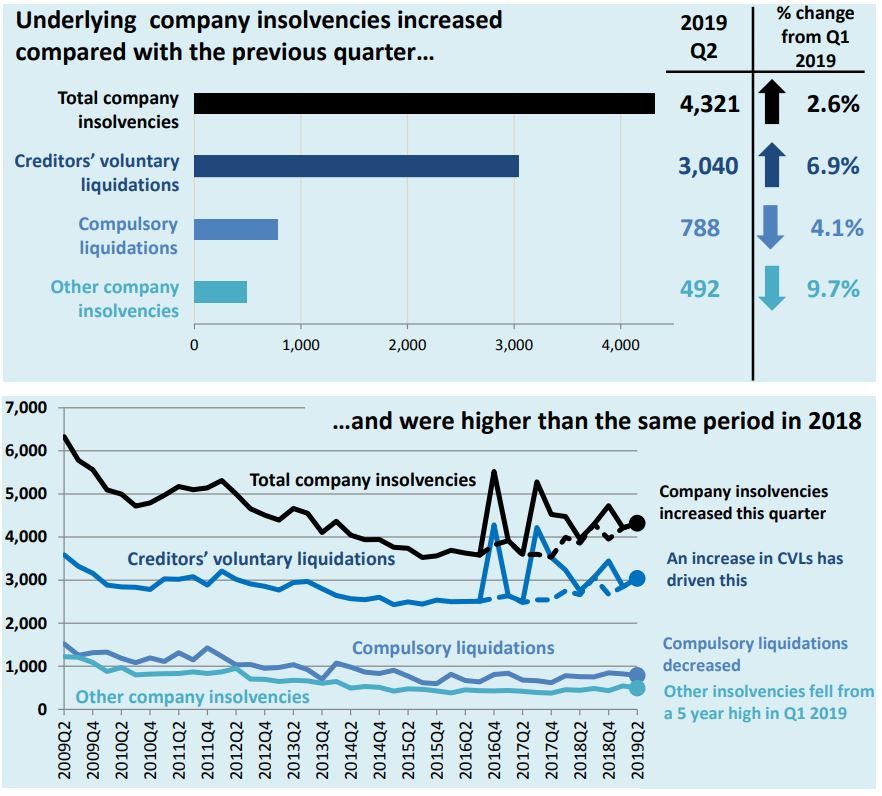

Creditor Voluntary Liquidations increased by 7%, in the quarter ending 30th June 2019, a total of 3,040 companies entered into a CVL procedure and used the current rules to manage their debt situation.

CVL’s make up over 70% of all company insolvencies in the UK and account for more than three times the amount insolvencies compared to compulsory liquidations and other insolvency options.

The overall number of CVL’s is on the rise and this may be in part to shareholders opting to resolve debt issues under existing rules as opposed to the new rules proposed for April 2020.

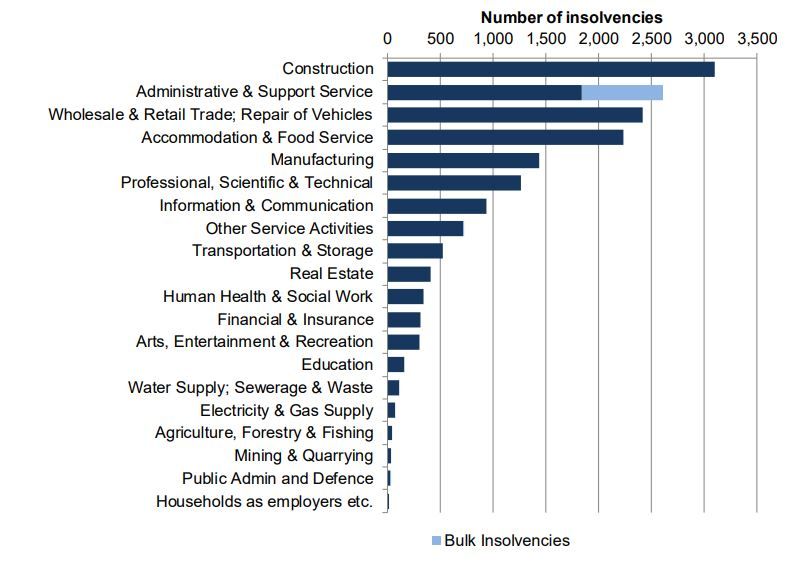

Industries most effected by CVL’s are services related businesses, predominately in support services and administration but also hospitality and unsurprisingly the construction industry.

Lies, damn lies & statistics

The numbers above are stark enough, however the trend may be worse. The line graph below shows a dashed line which the government kindly provide. This ‘excludes’ what they deem to be bulk insolvencies, this phrase refers to a large number of companies in the same industry entering into a CVL.

The spikes you see on this graph include bulk insolvencies and are related to personal service companies, contractor companies entering into a CVL. The increase in insolvencies across these companies relate directly to the introduction of legislation concerning IR35 in the public sector.

CVL Liquidation

Change Ahead

From 6 April 2020, when a business enters insolvency, HMRC will claim that tax collected or deducted is essentially held temporarily on trust. As such those amounts will be owed in preference of other creditors. This could have wide reaching implications where finance or credit terms are provided in conjunction with a preferential charge on the business.

In the words of HMRC: ‘This reform will apply to taxes collected and held by businesses on behalf of other taxpayers such as:

- VAT

- PAYE Income Tax

- employee National Insurance contributions

- student loan deductions

- Construction Industry Scheme deductions

Summary

It is a legal requirement under the companies act for directors to protect shareholder assets and hence address any liquidity issues in good time.

There are some 1,550 licenced insolvency practitioners in the UK and we work with the very best in the industry.

If you are experiencing issues paying debts or HMRC taxes on time, call us today to discuss how we can help . The sooner you address debt issues the more options you may have, not addressing the issue will undoubtedly restrict your options and ultimately could result in the matter being taken out of your hands.