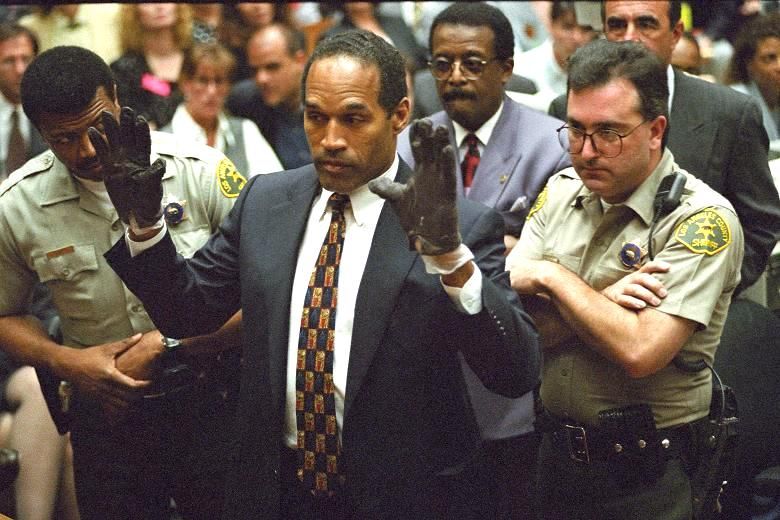

If the glove don’t fit…not all legal fees are deductible

It is often assumed that legal fees incurred, and often paid for directly by a business will automatically be a tax deductible expense, however as a multitude of tribunal cases have shown, this area can be a minefield, and trying to establish whether or not a cost is tax deductible in year one, or at all, is often not a binary process.

Back to basics

When a business incurs legal fees, or is subject to other associated costs such as damages or penalties linked to court action, normal principles will apply in determining deductibility.

Costs will not be allowable if they fail the ‘wholly and exclusively’ test or if they are capital rather than revenue in nature, or if they make up a loss which is not connected with or arises from the trade.

Whether the action is successful or not has no bearing on the status of the expense.

Legal costs in connection with leases can be treated as revenue or capital expenditure. The general principle is that the initial purchase of a lease will be capital, so costs associated with that will not be deductible in the first year,

The renewal of a lease may also involve legal and professional fees, and these will also in the main be capital expenditure, though if the renewal is of a short lease, the amount is likely to be small and may be allowed.

The ‘Wholly and exclusively’ test

The ‘wholly and exclusively’ test is slightly more difficult to assess as there is perhaps a certain amount of subjectivity.

As an example, payment of compensation to a customer for injury would possibly be considered to be wholly and exclusively for the purpose of the trade, however, the 1906 case Strong & Co of Romsey v Woodfield involved injury to a customer and a payment for damages that was considered not to be deductible. So again, we have to review the facts and revert to case law to establish how we treat such expenditure.

Fines

Fines, penalties, damages and the legal costs associated with them will not be allowed as deductions when the penalties are for infractions of the law. It is stated that a company must be able to operate its business and make a profit without breaking the law.

Likewise costs incurred in settling an action for a breach of the law will not be allowable, even if the legal action takes place overseas or the breach relates to a jurisdiction other than the UK.

Summary

It is essential that first principles are not overlooked when we are dealing with legal and professional costs.

The same rules that apply when looking at the allowability of any expense, in particular the wholly and exclusively test and whether the expense is capital or revenue in nature, holds true for legal and professional fees.

It is by having a deep understanding of these aspects, supported by relevant case law precedent, that you will arrive at the correct treatment, and this often allows for planning and structuring to ensure that optimal relief is achieved.

We are able to advise individuals and incorporated entities how best to manage these costs, if you would like to speak to one of our Chartered Accountants, please contact us today to arrange a free consultation in Brentwood, Canary Wharf or Manchester.

Legal expenses paid to a solicitor and barrister dealing with a Compulsory Purchase Order involving an expert valuer,accountant .

The fees paid to the Experts can be identified as a revenue or capital expense however how do we apportion the legal expenses paid to the solicitor and barrister?