ATED

Since the announcement of changes in mortgage interest rate relief for individual landlords, there has been a marked increase in the number of landlords seeking to incorporate their portfolios.

Incorporated, or enveloped dwellings as they are known, avoid the changes in interest rate relief, however they also bring with them new reporting obligations.

It is essential Directors understand their responsibility and have the correct advice around this as non-compliance can lead to penalties exceeding £1,600 per property per year, excluding any additional fines based on lost revenue.

The annual tax on enveloped dwellings [ATED] applies to UK residential properties held within corporate envelopes.

The tax was introduced on 1 April 2013 as a disincentive or tax raiser for Russian oligarchs and similar ilk and requires annual reporting and payments of tax where tax is due.

Latest statistics, released on 31 January 2017, show that it raised £178m in 2015-16 when the threshold was £1m or more. Fully 97% of the receipts arise in London and the South East, but astonishingly 80% are solely in the City of Westminster and the borough of Kensington and Chelsea.

Incorporated properties need to review the following checklist annually:

- Is the dwelling treated as non-residential?

- Is the dwelling below the £500,000 threshold?

- Is the entity or building itself specifically exempt from ATED?

If none of the above applies a return is required from the company.

HMRC confirms that some dwellings are specifically ‘non-residential’.

These include:

- hotels;

- guest houses;

- boarding school accommodation;

- hospitals;

- student halls of residence;

- military accommodation;

- care homes

These do not even need a relief declaration return.

Below the reporting requirement

If it looks as if the dwelling is still potentially subject to ATED, consider whether the value of the dwelling is at the de minimis of £500,000 or less.

For flats, consider the threshold by each dwelling, not by the value of the entire block unless separate dwellings are occupied by persons connected to the owner.

Valuations

The £500,000 figure is the threshold for 2016-17 and 2017-18, but the valuation date to be used is as at 1 April 2012 if the property was owned then, or the value at a later acquisition date.

For a newly constructed dwelling or one adapted between the normal valuation dates, the valuation date is different again, and is the earlier of the day on which the dwelling is deemed to come into existence for council tax and the day on which it is first occupied.

It should be noted that because the valuations stick for five years, 2018-19 returns will require a revised valuation date of the dwelling as at 1 April 2017.

A formal valuation is not required, but HMRC will expect the figure to be robust and reasonable.

If the value is below £500,000, this will not need a relief declaration return.

Needs a return

There are many reliefs available. The following properties are ‘in scope, but relieved from charge’ and will need the shorter relief declaration return:

- property rental businesses (to include the special conditions: sale, demolition and conversion);

- dwellings opened to the public;

- property developers (including qualifying exchange of dwellings interests);

- property traders carrying on a property trading business;

- financial institutions acquiring dwellings in the course of lending;

- dwellings used for trade purposes (occupation by qualifying employees and partners);

- farmhouses (occupation for the purposes of carrying on a trade of farming); and

- registered providers of social housing.

Tax rates

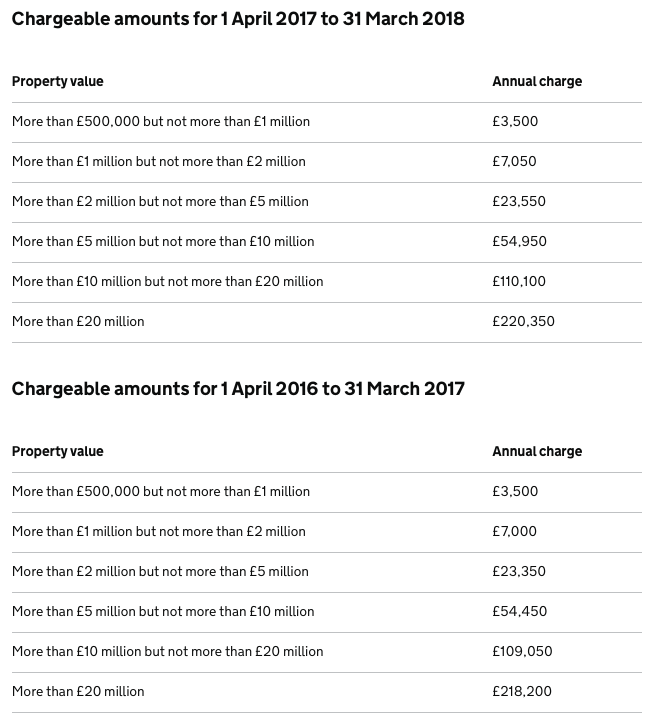

ATED tax rates

Summary

If you are a landlord, incorporated or otherwise, it is essential you understand the relevant legislation and have the correct advice essential for planning and structuring your affairs, protecting your assets and net income.

We offer free consultations, contact us today to arrange a face to face meeting to discuss your situation.