HMRC 2017/18 Tax Return

With over 11.4 million people falling under Self-Assessment, January is always an exceptionally busy month for Accountants. It is amazing how many people still leave it until the last minute to file their tax return.

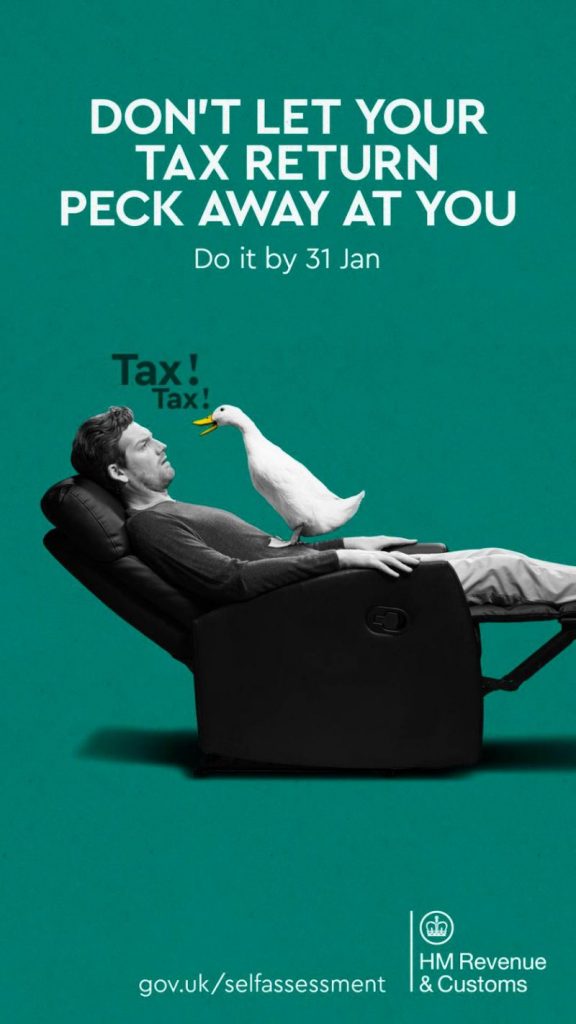

With the tax year end falling some nine months earlier on 5th April, the 31st January still seems to be the favoured deadline. It’s this procrastination that has prompted HMRC to launch a new advertising campaign targeting those leaving it until the last minute to submit returns, surprising this campaign is using ‘Ducks” to remind us to file and pay tax?

As well as stuffing down the turkey, clearing away wrapping paper and fending off rows with the family, thousands of Britons found another way to entertain themselves on Christmas Day, by submitting their tax return.

Christmas Day saw 2,590 self-assessment returns filed online followed by 7,655 on Boxing Day.

If you think that is bad, as Santa was flying around the world on Christmas Eve, 6,033 online returns were filed, 92 of them between 11pm and midnight, the elves maybe?

If you have still not filed your tax return, we offer fixed fee engagements covering all submissions. All of our work is protected by professional indemnity cover and also Fee Protection, which will allow us to work free of charge on any enquiry HMRC may make into your tax return.

Contact us today for a FREE consultation and quotation.

2017/18 Tax Return